/

RSS Feed

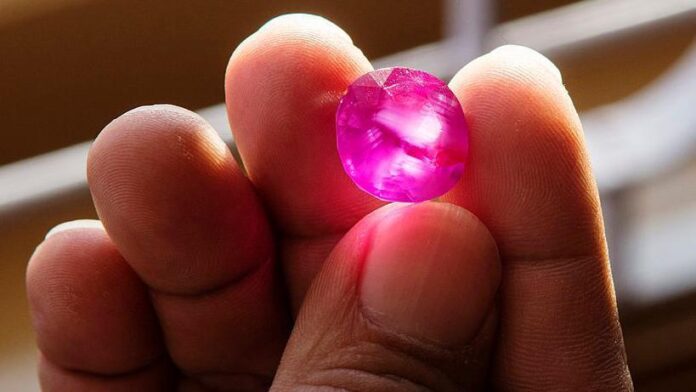

The Malawian government is seeking an extraordinary $309 billion from US-based Columbia Gem House, alleging unpaid taxes and royalties for rubies exported from the country over the past decade, Attorney General Thabo Chakaka Nyirenda said.

Columbia Gem House, a family-owned business that promotes fair trade practices, dismissed the claim as “baseless and defamatory,” arguing that Malawi’s figures are unrealistic and unfounded.

Multinationals Under Fire

In addition to the claim against Columbia Gem House, Malawi is demanding $4 billion from French energy giant TotalEnergies over a disputed oil storage deal and $9.5 million from Turkish tobacco company Star Agritech for allegedly unpaid revenues from a 2013 transaction.

-

TotalEnergies: The company allegedly stopped making payments under a fuel supply agreement after 2006. Malawi has taken legal action to recover what it claims is owed.

-

Star Agritech: The government accuses the firm of purchasing $15 million worth of tobacco but failing to pay. Star Agritech denies the claim, insisting it only bought $5 million worth of substandard tobacco.

A Claim That Staggers Malawi’s Economy

The combined $322.5 billion being sought from these multinationals is nearly 300 times Malawi’s national debt ($1.2 billion) and more than 22 times its GDP ($14 billion). The country, which sought a $174 million bailout from the IMF last year, says it is determined to recover revenue it believes was wrongfully withheld.

Nyirenda said the $309 billion claim against Columbia Gem House is based on evidence, including the company’s own declarations and deleted website information.

Columbia Gem House countered by saying that the claim is absurd, as it implies Malawi exported trillions of dollars’ worth of gemstones—a figure the company says is “beyond any stretch of the imagination.”

The company also denied direct operations in Malawi, saying it sourced gemstones from Nyala Mines, a Malawian firm in which the government has a 10% stake. However, Nyirenda alleges the company disguised ownership and undervalued exports.

Broader Implications

Economist Wisdom Mgomezulu suggests Malawi’s financial struggles might be driving its aggressive pursuit of multinationals. “They’re looking at all potential sources of income, but the scale of these claims far exceeds the size of the economy,”.

Mining contributes just 1% to Malawi’s GDP, but the government has pledged to increase this share in the coming years.

Context of Growing Disputes

Malawi is not alone in challenging multinational companies over unpaid revenues:

-

Mali recently issued an international arrest warrant for Barrick Gold’s CEO, claiming the Canadian firm owes $500 million in taxes.

-

Resolute Mining, an Australian company, paid $80 million upfront to settle a $160 million tax dispute in Mali.